Last year, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs. Below are the costs of Medicare.

| MEDICARE COSTS | 2020 | 2021 |

|---|---|---|

| Premium Part B | $144.60 | $148.50 |

| Premium Part A (if you buy) | $458 | $471 |

| Part B Deductible | $198 | $203 |

| Part A Deductible | $1408 | $1484 |

| Daily Part A Coinsurance for 61st-90th Day | $352 | $371 |

| Maximum Part D Deductible | $435 | $445 |

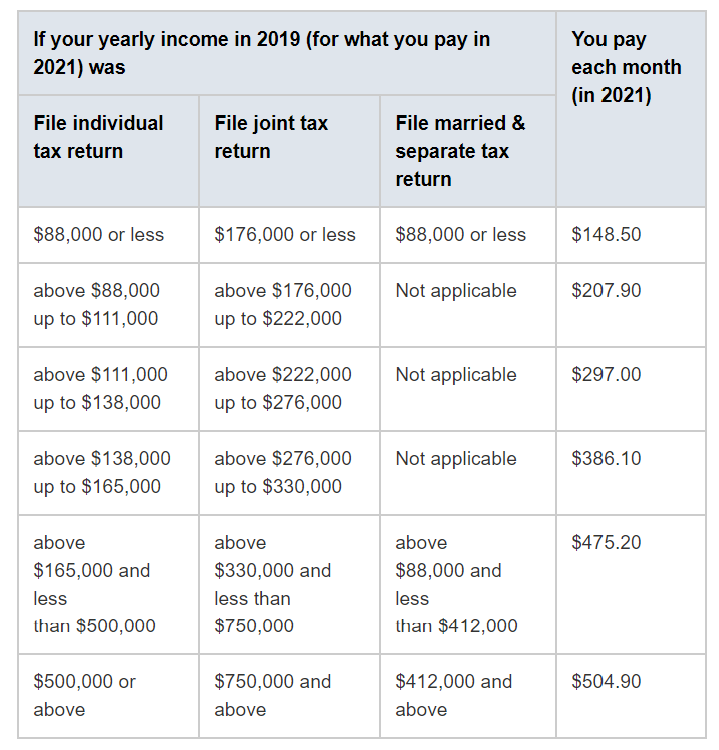

The standard Part B premium amount in 2021 is $148.50 per month. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago (2019) is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium. See the chart below.

You usually don’t pay a monthly premium for Medicare Part A (Hospital Insurance) coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called “premium-free Part A.” Most people get premium-free Part A.

Even if you don’t have enough credit or haven’t worked long enough (at least 10 years or 40 credits), you may pay premium-free part A based on your spouse’s working history. I find that this article from AARP is very informative about Medicare Coverage for non-working spouse. Check it out.