The standard Part B premium in 2023 will be $164.90/mo. This is lower compared to its 2022 premium, which was

The standard Part B premium in 2023 will be $164.90/mo. This is lower compared to its 2022 premium, which was

$170.10.

In the meantime, the annual deductible for Medicare Part B is $226 /year. This is important to know if you have a Medicare supplement plan G or N because you must meet the part B deductible before Medicare Supplement picks up the rest of the costs.

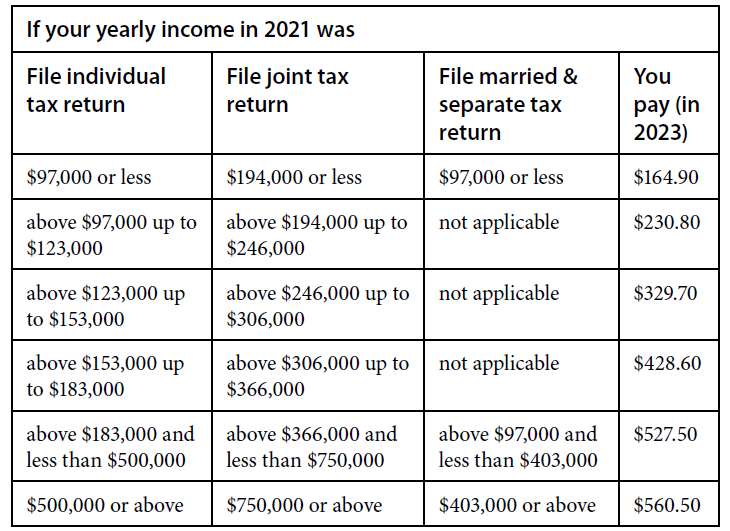

Part B Premium in 2023

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard Part B premium plus an income-related monthly adjustment amount. See the chart below for how much your premium should be.

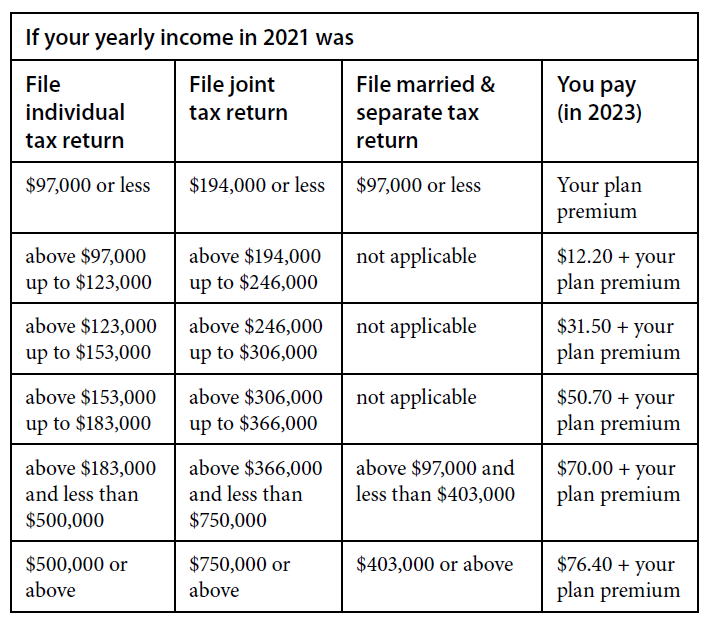

Part D Premium in 2023

The chart below shows your estimated drug plan monthly premium based on your income. If your income is above a certain limit, you’ll pay an income-related monthly adjustment amount in addition to your plan premium.

Each fall, Medicare will ask the IRS for information to determine next year’s premiums, they ask for tax information to verify your reports of changes affecting your income-related monthly adjustment amounts if any. When Medicare find a difference between the IRS information and information Medicare previously used that results in a change in your income-related monthly adjustment amounts, they will notify you of the change.

Some people received a new bill from Medicare that showed an increase in their Part B and D premiums late last year. Perhaps 2 years back they sold a rental property or received significant capital gains. They didn’t realize that with the extra income, their Medicare premiums would increase too.

Should you receive a letter from Medicare regarding any increase in your 2023 part B and D premiums, please call Medicare (1-800-MEDICARE) directly to inquire. I find that they’re very helpful in explaining the premium and the reason for the increase.